At Halal DeFi, we blend cutting-edge blockchain investments with the ethical rigor of Shariah-compliant finance. Our aim is ambitious: a 22% Internal Rate of Return (IRR)—a target grounded in data and strategy. But how do we plan to achieve this? Let’s break it down.

What Does 22% IRR Mean?

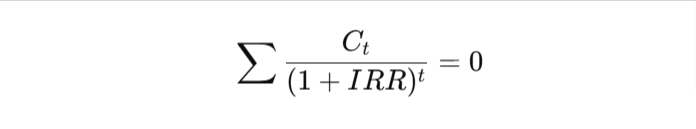

The Internal Rate of Return (IRR) is the annual growth rate of an investment over time. It's used to measure profitability while accounting for the time value of money. The higher the IRR, the more efficient and profitable the investment. Here’s the formula to calculate IRR:

Where:

- (C_t) = Net cash inflow during period (t)

- (t) = Time period (years)

- IRR = The rate of return we’re solving for.

In simple terms, an IRR of 22% means we aim to grow your investment by 22% each year. For example, a $1,000 investment would grow to approximately $2,702 after 5 years, assuming this target is met.

But let’s be clear—this is an internal target, not a promise. We’re working hard to achieve it by combining careful project selection, strategic asset management, and Shariah-compliant practices.

How We Plan to Achieve 22% IRR

- Early Access to High-Potential Web3 Projects: The blockchain space is still in its early stages, and early investments can yield massive returns. We focus on Web3 projects that are disrupting industries before they hit mainstream adoption. Past examples like Kaspa and Chainlink saw early investors achieve thousands of percent in returns as these projects scaled. Our team conducts rigorous due diligence to ensure each investment meets both growth potential and Shariah compliance—meaning no interest (riba), no speculation (gharar), and a focus on ethical industries.

- Active Asset Management: We don’t sit back and wait for the market to rise. Instead, we use active asset management strategies to enhance returns. Through strategic trading on decentralized exchanges (DEXs), we capitalize on short-term market opportunities while holding long-term positions. This allows us to: seize market fluctuations without taking on unnecessary risk and rebalance portfolios based on real-time market insights.

- Transparency and Security: Every transaction is recorded on the blockchain, ensuring full transparency. We use multi-signature (multisig) wallets for fund security, meaning no single person can execute a transaction without approval from multiple parties. This is industry-leading security, trusted by projects managing billions of dollars.

Key Investment Categories

Our strategy targets sectors with strong growth potential that are essential to blockchain’s mainstream adoption. While these are core areas, we remain open to new, innovative sectors aligned with our principles.

- Layer 2 Scaling Solutions (L2): As demand for blockchain scalability increases, Layer 2 solutions—such as rollups and sidechains—enable faster, more cost-effective transactions. These investments support infrastructure that enhances Web3 accessibility and efficiency.

- Real-World Assets (RWA) on Blockchain: Tokenizing assets like real estate and commodities enables fractional ownership and trading of tangible assets on blockchain, offering more stable returns and reducing volatility.

- Decentralized Finance (DeFi) Protocols: DeFi remains central to our portfolio, particularly protocols offering innovative, interest-free solutions for lending, borrowing, and liquidity, replacing traditional finance models with ethical, profit-sharing structures.

- Web3 Infrastructure: As the backbone of a decentralized internet, Web3 infrastructure—including decentralized identity, storage, and cross-chain interoperability—enables the broader adoption of blockchain technology.

- AI and Blockchain Integrations: AI-powered blockchain projects are revolutionizing data and automation on decentralized networks, leveraging AI for predictive analytics, decentralized decision-making, and data transparency.

Visualizing 5-Year Growth: Your $1,000 Investment

Here's how a $1,000 investment could grow with a 22% IRR over five years:

| Year | Investment Value ($) |

|---|---|

| 0 | 1,000 |

| 1 | 1,220 |

| 2 | 1,488 |

| 3 | 1,815 |

| 4 | 2,215 |

| 5 | 2,702 |

In this scenario, you could more than double your investment after five years, assuming we hit our target. However, as mentioned earlier, this is a plan, not a guarantee, given the inherent risks of the market.

Why Halal DeFi Stands Out: Comparing to Traditional Investments

Many investors wonder: how does this compare to traditional assets like gold or real estate?

- Gold: Historically, gold provides an average annual return of 7-10%. While it's a safe asset, it grows slowly.

- Real Estate: Over time, real estate has generated 8-12% annual returns, but it requires substantial upfront capital, and liquidity is often an issue.

Meanwhile, blockchain offers high-growth potential at the cutting edge of innovation. Early investors in key projects have often seen returns exceeding 100% in just a few years. By offering early access to game-changing blockchain projects, Halal DeFi gives you an opportunity to participate in the next wave of financial technology—while staying true to your ethical values.

A Realistic but Ambitious Target: 22% IRR

Let’s be honest—22% IRR is an ambitious target. But it's not without precedent in the world of crypto. Early-stage blockchain projects have regularly produced returns of 100% or more for those who invested early. We don’t aim to make wild promises; rather, we’re committed to a disciplined, data-driven approach to achieving these returns.

- Liquidity and Flexibility: Unlike traditional venture capital, where your money might be locked up for years, our platform allows you to buy and sell tokens anytime on decentralized exchanges, offering liquidity and flexibility for your investment.

Blockchain is revolutionizing global finance, and those who invest early in disruptive projects stand to gain the most. With Halal DeFi, you don’t have to compromise between strong returns and your values—you can achieve both.