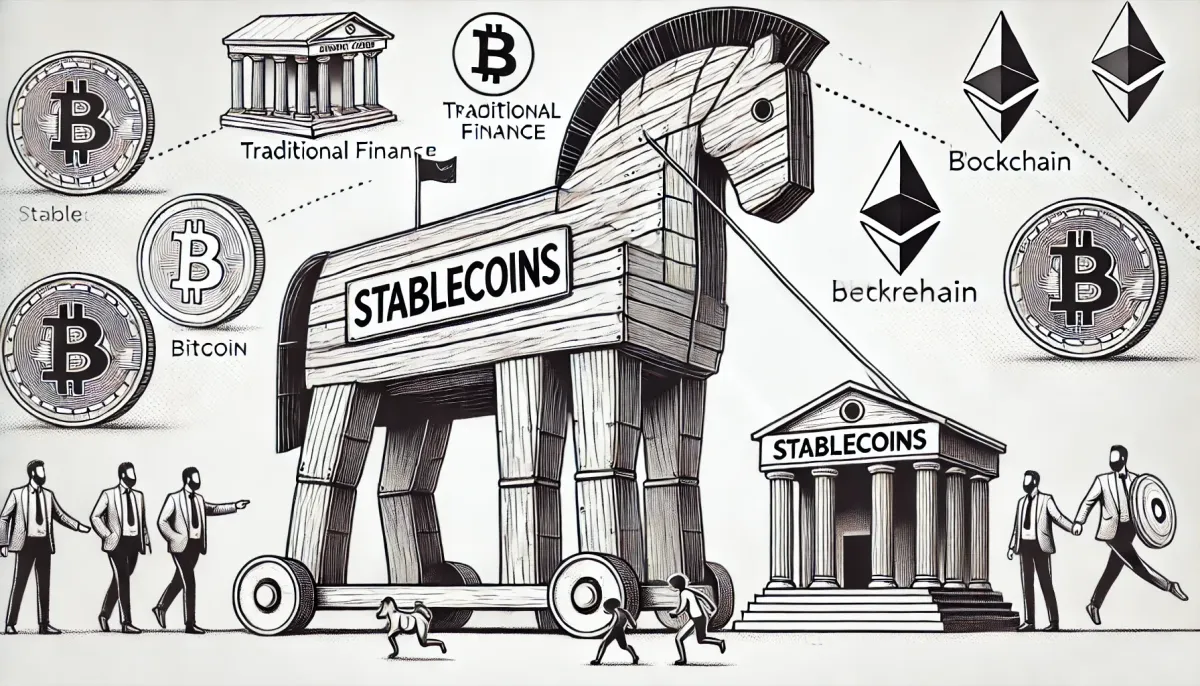

Stablecoins are quietly becoming the real heavyweights of the crypto world. While crypto headline grabbers—Bitcoin and Ethereum—do laps in the speculative sandbox, stablecoins are emerging as the asset class that could actually revolutionize finance. Why? They bridge the liquidity and stability of traditional money with the borderless, decentralized promise of blockchain. For a sector obsessed with shaking off the banking system, stablecoins might just be the Trojan horse that sneaks crypto into everyday financial life.

Let’s break it down.

1. Stablecoins: A Brief Overview

Think of stablecoins as digital dollars or euros—or even digital gold. Their value is “pegged” to something stable, like a fiat currency or commodity, keeping them largely immune to the wild price swings that make Bitcoin thrilling (or terrifying, depending on your risk tolerance). This makes stablecoins attractive for actual, practical uses, from buying coffee to transferring cash across borders in minutes. The value prop? A digital asset that’s as easy to move as an email but as predictable as cash in your bank account.

2. Flavors of Stablecoins

Stablecoins aren’t a monolith; they come in different structures, each with its own pros and cons:

- Fiat-Collateralized Stablecoins: Backed by good old cash reserves (U.S. dollars, etc.), held by a central entity. Think Tether (USDT) and USD Coin (USDC). The upside is stability, but it comes with trust in a central party—a bit ironic for the decentralization crowd.

- Crypto-Collateralized Stablecoins: Backed by other crypto assets like Ethereum, often over-collateralized to weather crypto’s volatility storms. DAI, created by MakerDAO, is the poster child here. It’s less stable in theory but can operate in a decentralized way.

- Algorithmic Stablecoins: These use smart contracts to balance supply and demand, maintaining price stability without backing from collateral. It’s the crypto purist’s dream, but reality has shown they can implode if confidence falters—see the UST/LUNA crash of 2022.

3. Rising Market Clout

In the past four years, stablecoins have surged from niche to necessary. Consider these metrics:

- Market Cap: At $172 billion as of September 2024, stablecoins represent the fastest-growing segment in crypto.

- Transaction Volume: Monthly stablecoin transactions hit $1.68 trillion in April 2024. That's a staggering increase—about 16 times what we saw just four years ago. Stablecoins are increasingly the grease in the crypto machine.

- User Adoption: We’re at 104.92 million stablecoin holders and counting. Adoption is up 15% this year alone—a sign that everyday users and institutions alike are onboard.

4. Core Use Cases

Stablecoins have already found a home in several vital financial applications:

- Cross-Border Payments: Remittances, international settlements—you name it. Stablecoins reduce friction, fees, and time compared to traditional banking methods. And for the 1.4 billion people worldwide without a bank account, this is more than hype; it’s access.

- Decentralized Finance (DeFi): In the DeFi ecosystem, stablecoins are the lifeblood. They act as collateral for loans, the asset for yield farming, and the currency of choice in a world where volatility can wipe out gains in seconds.

- Trading and Hedging: Stablecoins provide a haven for crypto traders. In a crash, they’re a quick refuge from volatility, preserving capital and offering a bridge back to fiat, if needed.

- Store of Value: For users in countries with volatile local currencies, stablecoins represent a way to keep value without relying on local banking infrastructure. When your currency loses 20% of its value overnight, a stablecoin pegged to the U.S. dollar is a lifeline.

5. Developments Driving Growth

The last few years have seen an infusion of legitimacy into stablecoins, and the change isn’t just technical—it’s institutional and regulatory.

- Institutional Interest: PayPal has rolled out its own stablecoin, and Visa is setting up platforms to transact with fiat-backed tokens. These developments aren’t just experiments; they’re indications that the big guns see stablecoins as the future of payments.

- Regulatory Focus: As the stablecoin market grows, regulators are homing in. Governments recognize the potential here—not only for innovation but for risks to financial stability. In the U.S., stablecoins may soon be regulated similarly to banks. Whether that helps or hinders adoption remains to be seen.

- Technological Advances: As blockchain infrastructure becomes faster, cheaper, and more secure, stablecoins are becoming easier to use and integrate into mainstream applications.

6. The Dark Clouds: Challenges Ahead

For all their promise, stablecoins still have hurdles to clear:

- Regulatory Compliance: Navigating an evolving regulatory landscape is essential. Without a consistent approach across countries, stablecoins could face fragmented adoption.

- Transparency: Fiat-collateralized stablecoins rely on trust in their backers—Tether’s history of opaque auditing practices illustrates why users demand regular, transparent audits.

- Competition: As more stablecoins enter the market, brand trust and market share will be critical. Who wants to hold a stablecoin no one else trusts?

The Bigger Picture

Stablecoins are laying the groundwork for a hybrid financial future—one where you can send money as quickly as you send a text, without the fees and delays of legacy banking. In economically unstable regions, they’re a potential hedge against inflation. For DeFi, they’re fuel and ballast.

If we’re at a crossroads between traditional finance and the decentralized world of crypto, stablecoins are the on-ramp everyone is taking. They’re not just another blockchain innovation; they’re infrastructure. And as regulatory clarity emerges, stablecoins may prove to be the catalyst that pushes crypto from speculative asset class to practical financial tool.